18 DEFERRED TAX CONTINUED¡

Notes (Continued):

(c) Deferred tax liabilities are calculated in full on temporary di

erences under the liabilities method using the tax rate of

the countries in which the Group operated. The temporary di

erences are for accelerated depreciation allowances, fair

value adjustments arising from acquisitions and withholding taxes arising from unremitted earnings.

(d) Deferred tax assets and liabilities are expected to be recovered or settled mostly after more than twelve months.

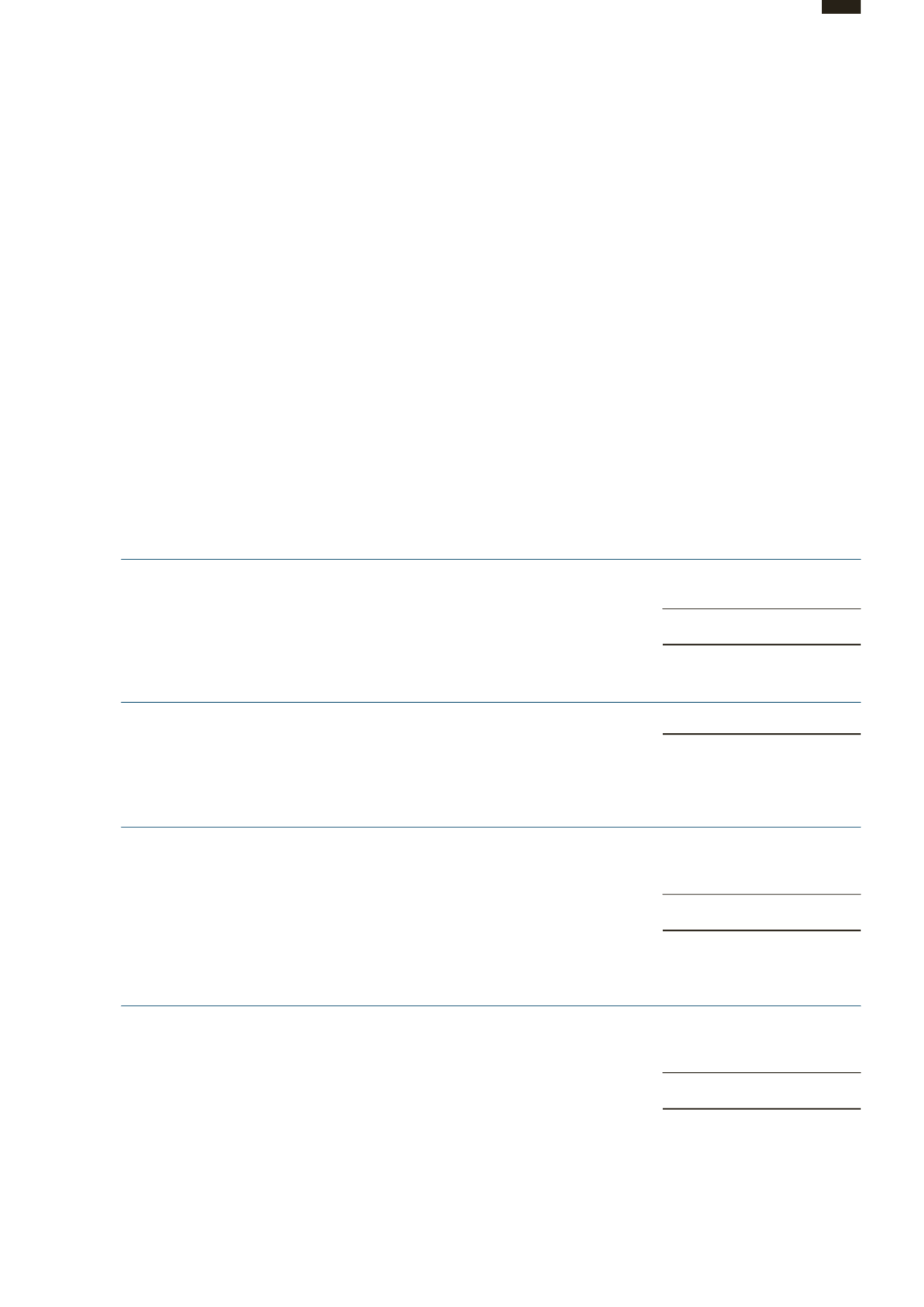

19 CASH AND CASH EQUIVALENTS

Group

2015

2014

HK$’000

HK$’000

Cash at bank and on hand

472,085

325,743

Short-term bank deposits

6,368,725

7,473,063

6,840,810

7,798,806

Trust

2015

2014

HK$’000

HK$’000

Cash at bank and on hand

3,723

2,133

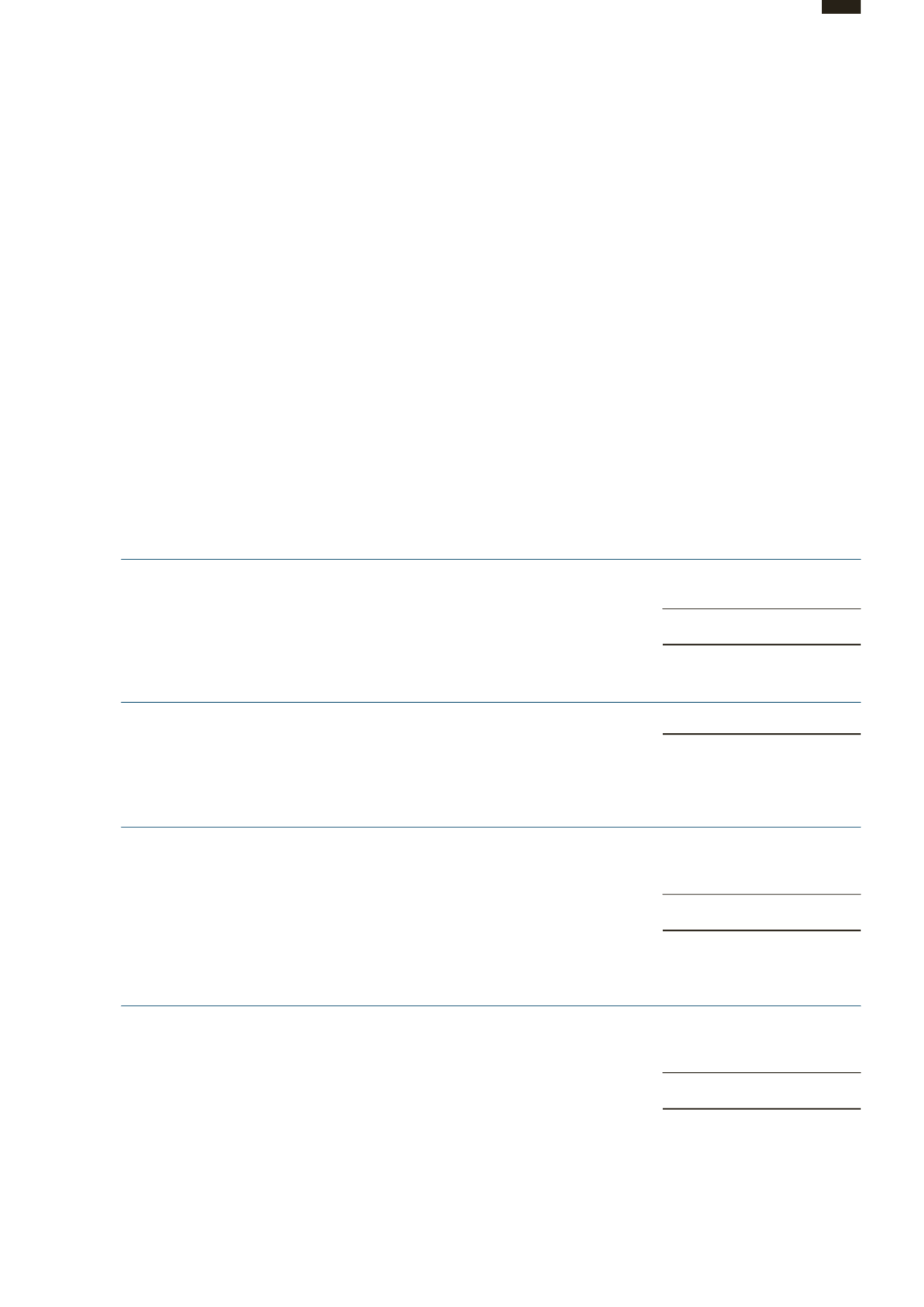

Cash and cash equivalents are denominated in the following currencies:

Group

2015

2014

Percentage

Percentage

Hong Kong dollar

60%

60%

Renminbi

14%

26%

United States dollar

26%

14%

100%

100%

Trust

2015

2014

Percentage

Percentage

Hong Kong dollar

72%

49%

United States dollar

3%

30%

Singapore dollar

25%

21%

100%

100%

The carrying amounts of cash and cash equivalents approximate their fair values. The maximum exposure to credit risk is the

carrying amounts of the cash and cash equivalents.

Notes to the

Financial Statements

097

ANNUAL REPORT 2015

HUTCHISON PORT HOLDINGS TRUST