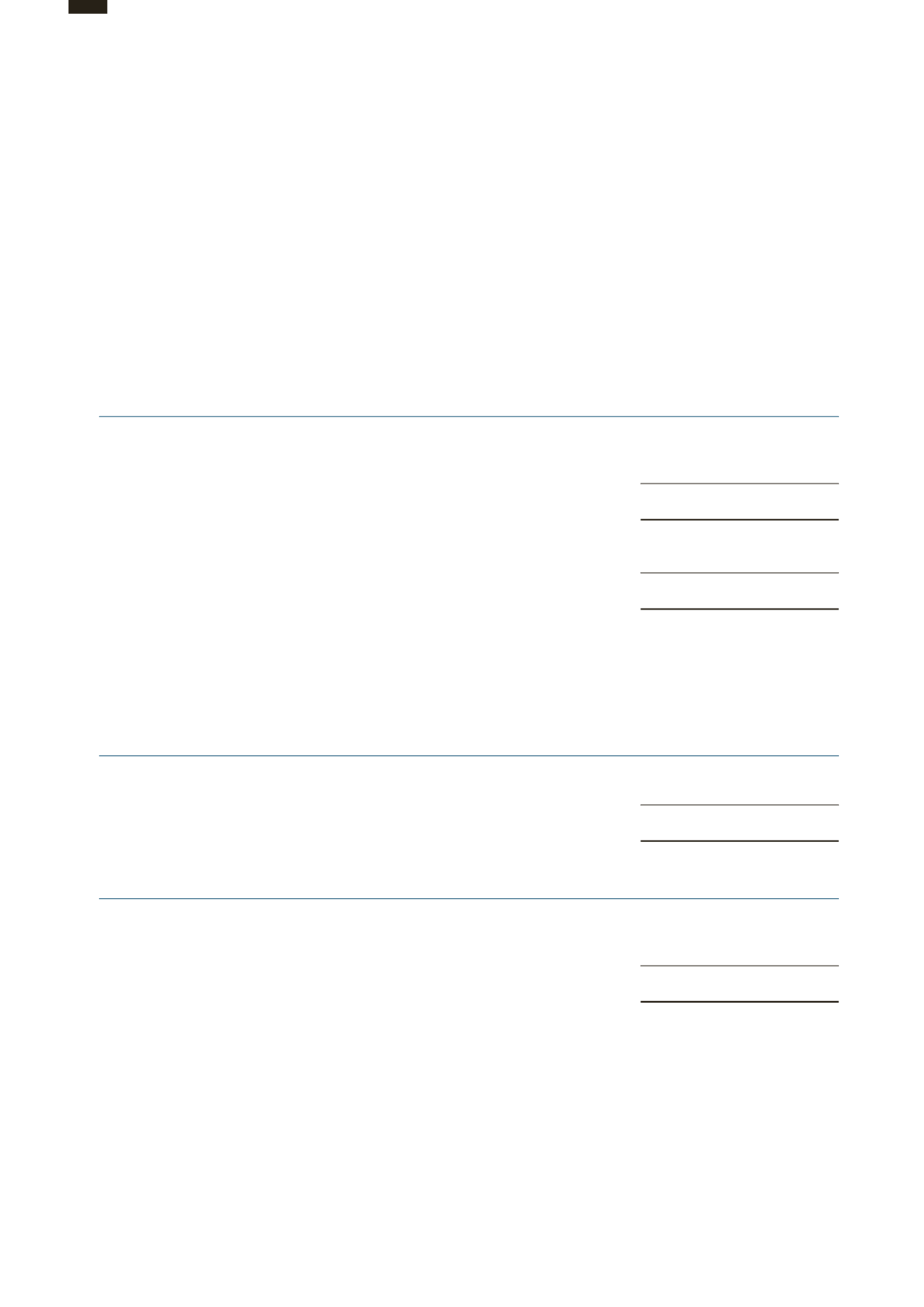

14 INTANGIBLE ASSETS

(a) Customer relationships

Group

2015

2014

HK$’000

HK$’000

Net book value

At beginning of the year

7,172,802

7,507,008

Amortisation

(334,206)

(334,206)

At end of the year

6,838,596

7,172,802

Cost

8,440,000

8,440,000

Accumulated amortisation

(1,601,404)

(1,267,198)

At end of the year

6,838,596

7,172,802

(b) Goodwill

Goodwill is allocated to the Group’s cash-generating unit (“CGU”) identified according to geographical locations as the

Group has one business segment only. The goodwill is allocated as follows:

Group

2015

2014

HK$’000

HK$’000

Hong Kong

1,666,002

1,666,002

Mainland China

20,963,042

20,963,042

22,629,044

22,629,044

Group

2015

2014

HK$’000

HK$’000

At beginning of the year

22,629,044

42,500,443

Disposal of subsidiary companies

-

(871,399)

Impairment of goodwill (accumulated: HK$19.0 billion)

-

(19,000,000)

At end of the year

22,629,044

22,629,044

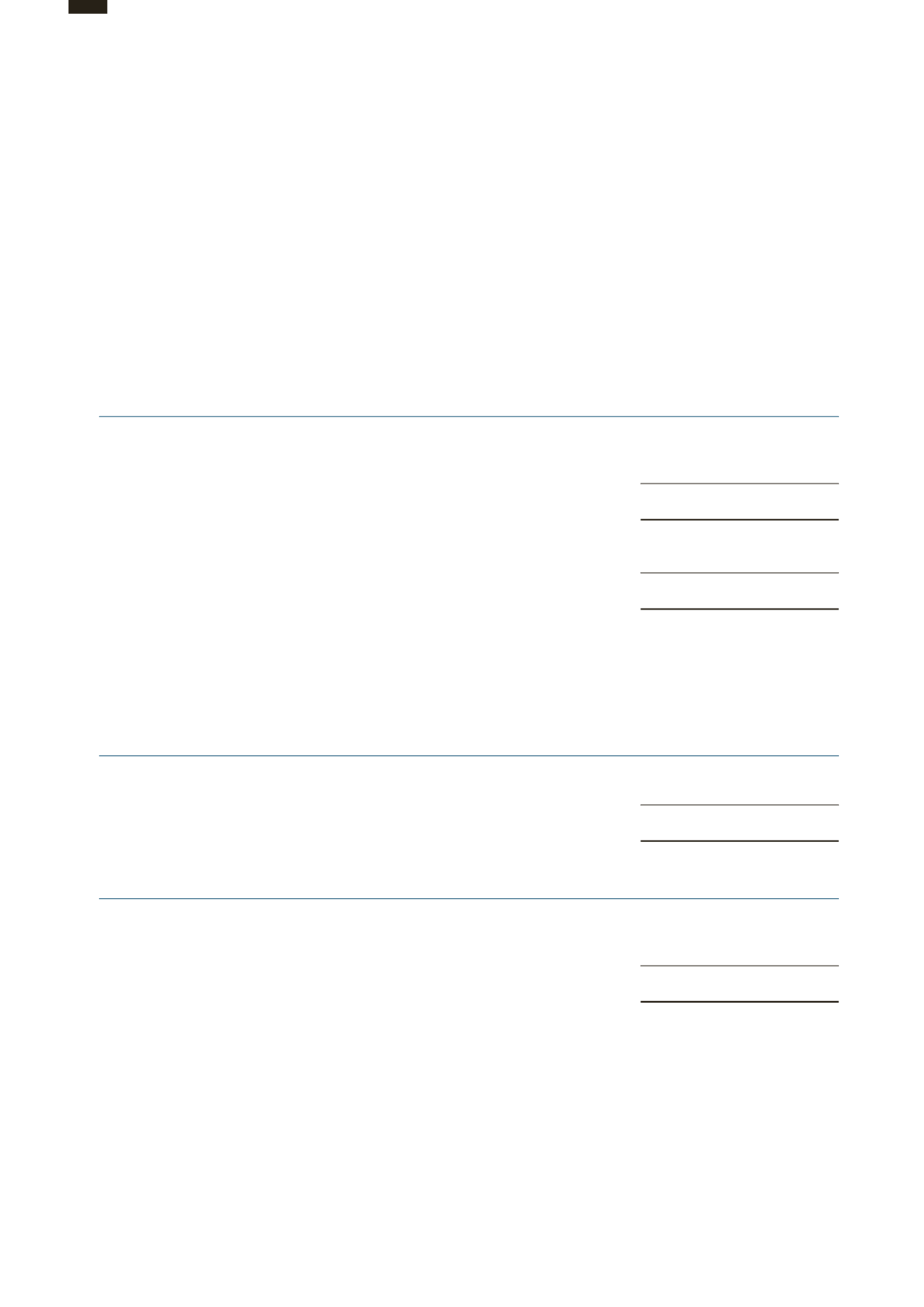

Management performed an impairment assessment as at 31 December 2015 based on value-in-use calculations and considered

that no further impairment of goodwill is required. As in prior years, the impairment methodology assumed terminal values and

discount rates of 2% - 3% and 8% - 10% per annum, respectively. Terminal values are determined by considering both internal and

external factors relating to the port operation and discount rates reflect specific risks relating to the relevant business.

The assumptions regarding the growth rates in revenue and cost of services rendered used in the current year’s assessment

of the Hong Kong CGU were comparable to last year. For illustration purposes, a hypothetical 0.5% decrease in the revenue

growth rate, a 0.5% increase in costs of services rendered and a 0.5% increase in the discount rate, with all other variables

and assumptions held constant, would decrease the recoverable amount of the Hong Kong CGU, by HK$3.2 billion, HK$1.9

billion and HK$1.7 billion, respectively.

Actual results in the future may di

er materially from the sensitivity analysis due to developments in the global markets and changes

in economic conditions which may cause fluctuations in growth and market interest rates to vary and therefore it is important to

note that the hypothetical amounts so generated do not represent a projection of likely future events and profits or losses.

Notes to the

Financial Statements

OPTIMISING FOR THE FUTURE

092