5

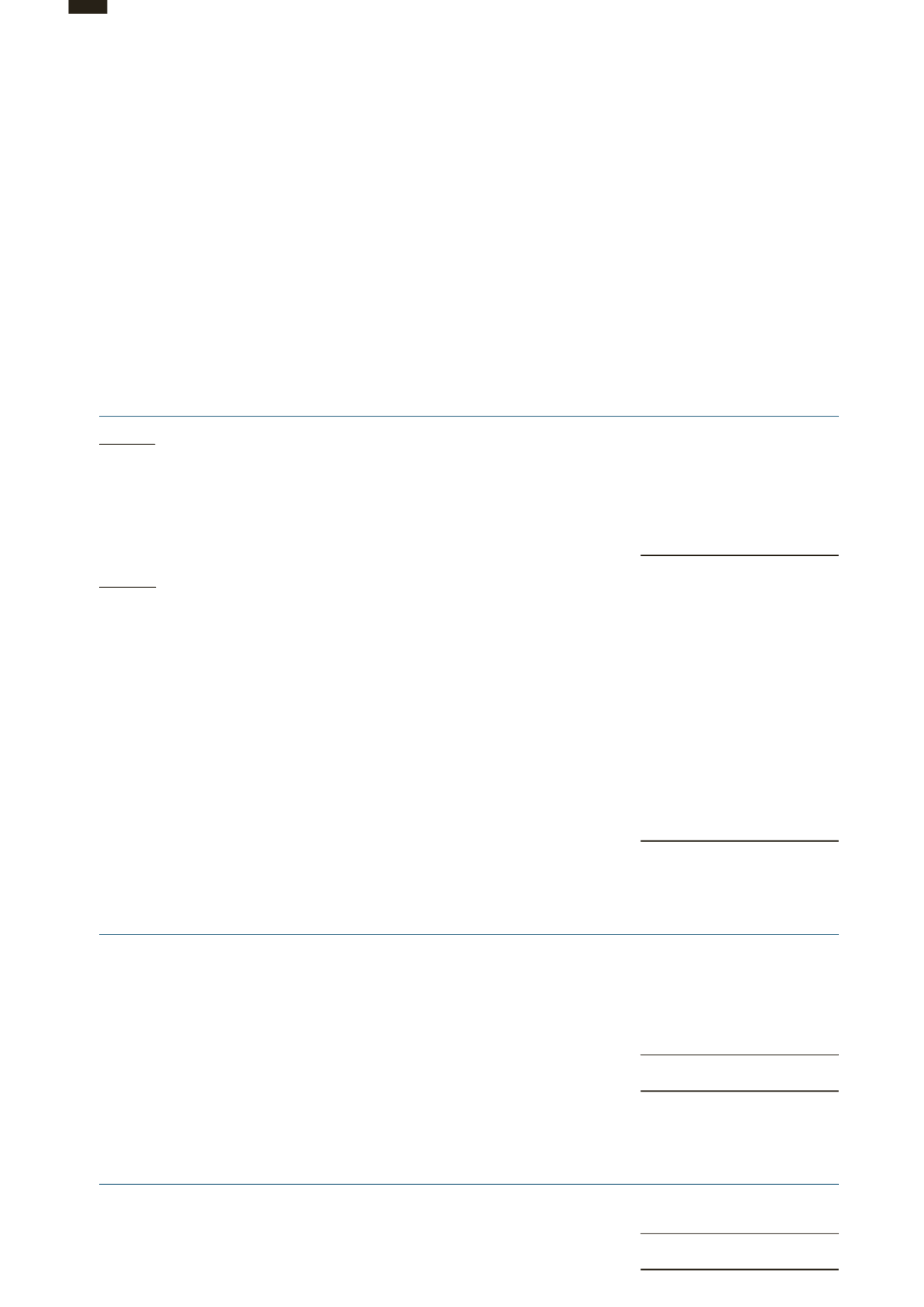

OPERATING PROFIT

Operating profit is stated after crediting and charging the following:

2015

2014

HK$’000

HK$’000

Crediting

Dividend income from River Ports Economic Benefits (Note 17)

19,605

47,410

Net exchange gain

3,305

-

Net gain on disposal of fixed assets

-

1,926

Net gain on disposal of subsidiary companies

-

243,777

Gain on cessation of economic benefits of an investment

155,532

-

Charging

Auditor’s remuneration

- audit services

14,461

14,521

- non-audit services

1,751

502

Amortisation

- leasehold land and land use rights

1,265,546

1,270,832

- railway usage rights

557

568

- customer relationships

334,206

334,206

Depreciation of fixed assets

1,220,886

1,199,741

Net loss on disposal of fixed assets

2,733

-

Operating lease rentals

- o¢ce premises and port facilities

54,057

66,496

Sta

costs included in cost of services rendered

1,314,636

1,301,366

Net exchange loss

-

61,462

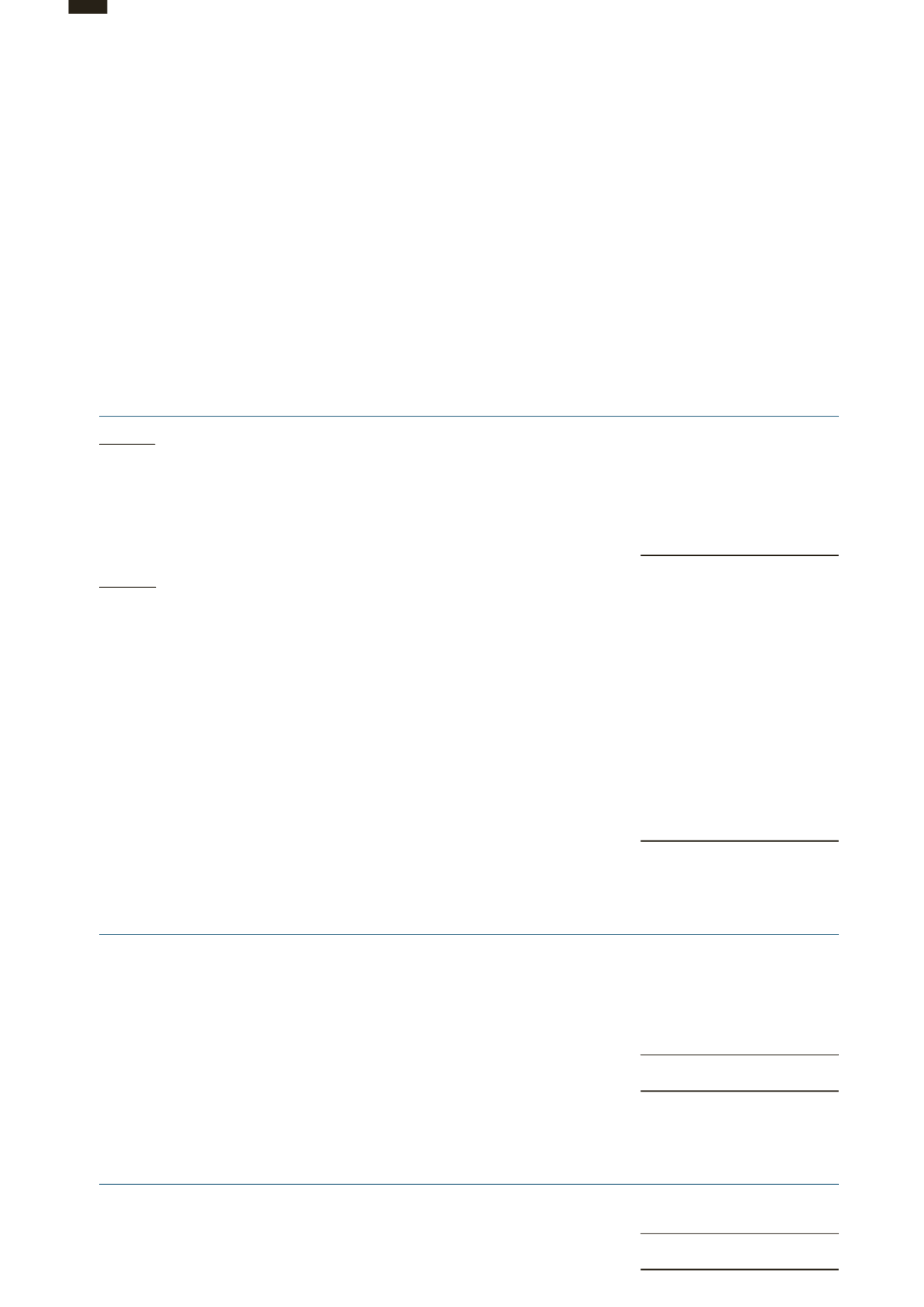

6

INTEREST AND OTHER FINANCE COSTS

2015

2014

HK$’000

HK$’000

Bank loans and overdrafts

464,582

517,901

Guaranteed notes

103,480

-

Loans from non-controlling interests

1,519

1,519

Other finance costs

54,621

66,686

Fair value loss on interest rate swaps

38,784

-

Less: fair value adjustment to bank and other debts under fair value hedge

(38,784)

-

624,202

586,106

7

TAX

2015

2014

HK$’000

HK$’000

Current tax

1,062,983

1,001,289

Deferred tax (Note 18)

(238,089)

(270,317)

824,894

730,972

Notes to the

Financial Statements

OPTIMISING FOR THE FUTURE

088