7

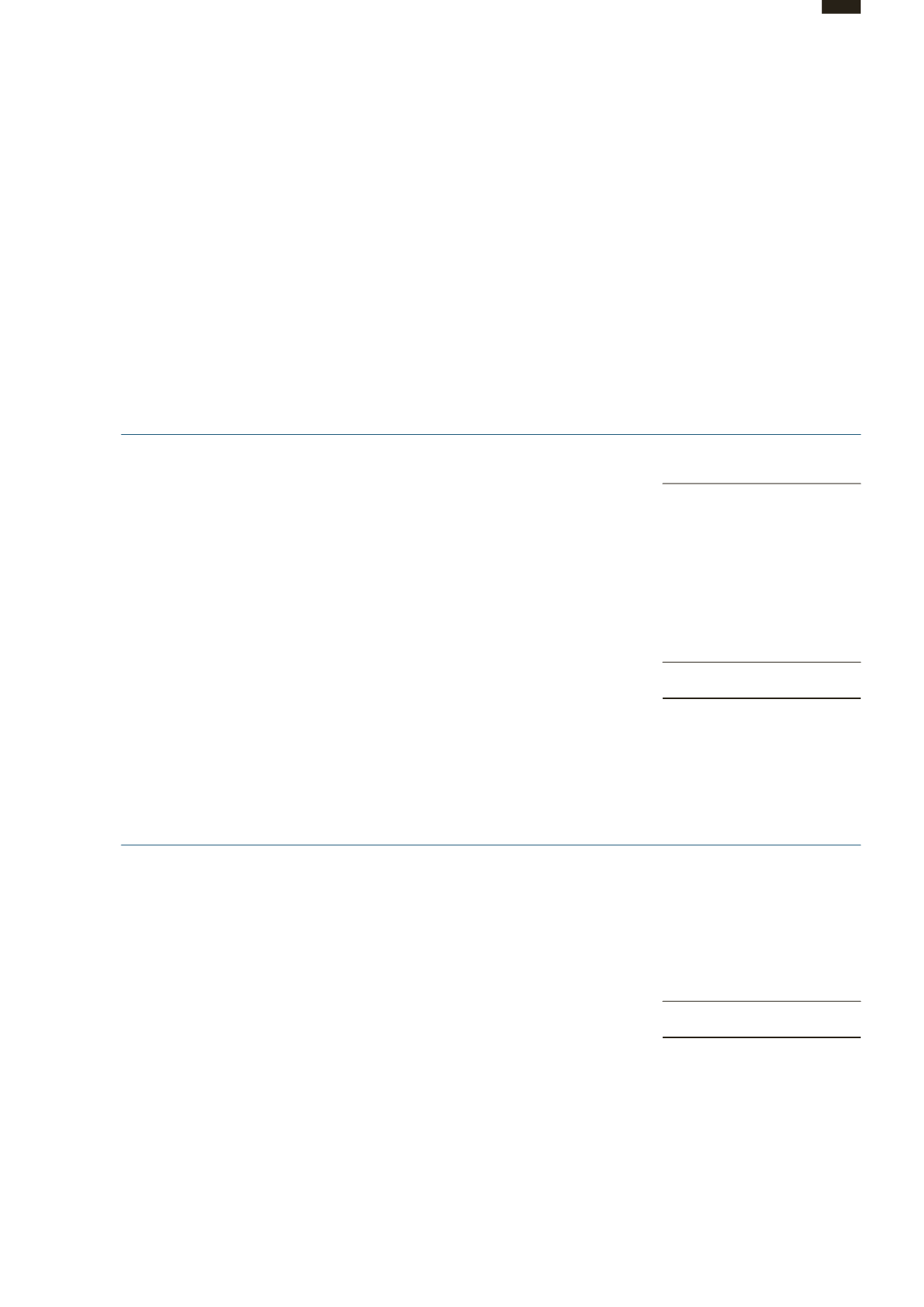

TAX CONTINUED¡

The tax charge on the Group’s profit before tax di

ers from the theoretical amount that would arise using the weighted

average tax rate of the Group as follows:

2015

2014

HK$’000

HK$’000

Profit before tax excluding share of profits less losses after tax of joint ventures

and associated companies and impairment of goodwill (Note)

3,728,489

3,574,155

Tax calculated at weighted average tax rate of 24.4% (2014: 24.0%)

908,360

858,176

Tax exemption in the PRC

(242,104)

(216,066)

Income not subject to tax

(29,694)

(54,386)

Expenses not deductible for tax purposes

57,855

63,295

Withholding tax on unremitted earnings

121,888

113,124

Utilisation of previously unrecognised tax losses

(623)

(11,003)

Under/(over) provision in prior year

6,229

(25,461)

Tax losses not recognised

1,745

3,403

Others

1,238

(110)

Total tax

824,894

730,972

Note:

A one-o

, non-cash goodwill impairment loss of HK$19.0 billion was recognised in 2014.

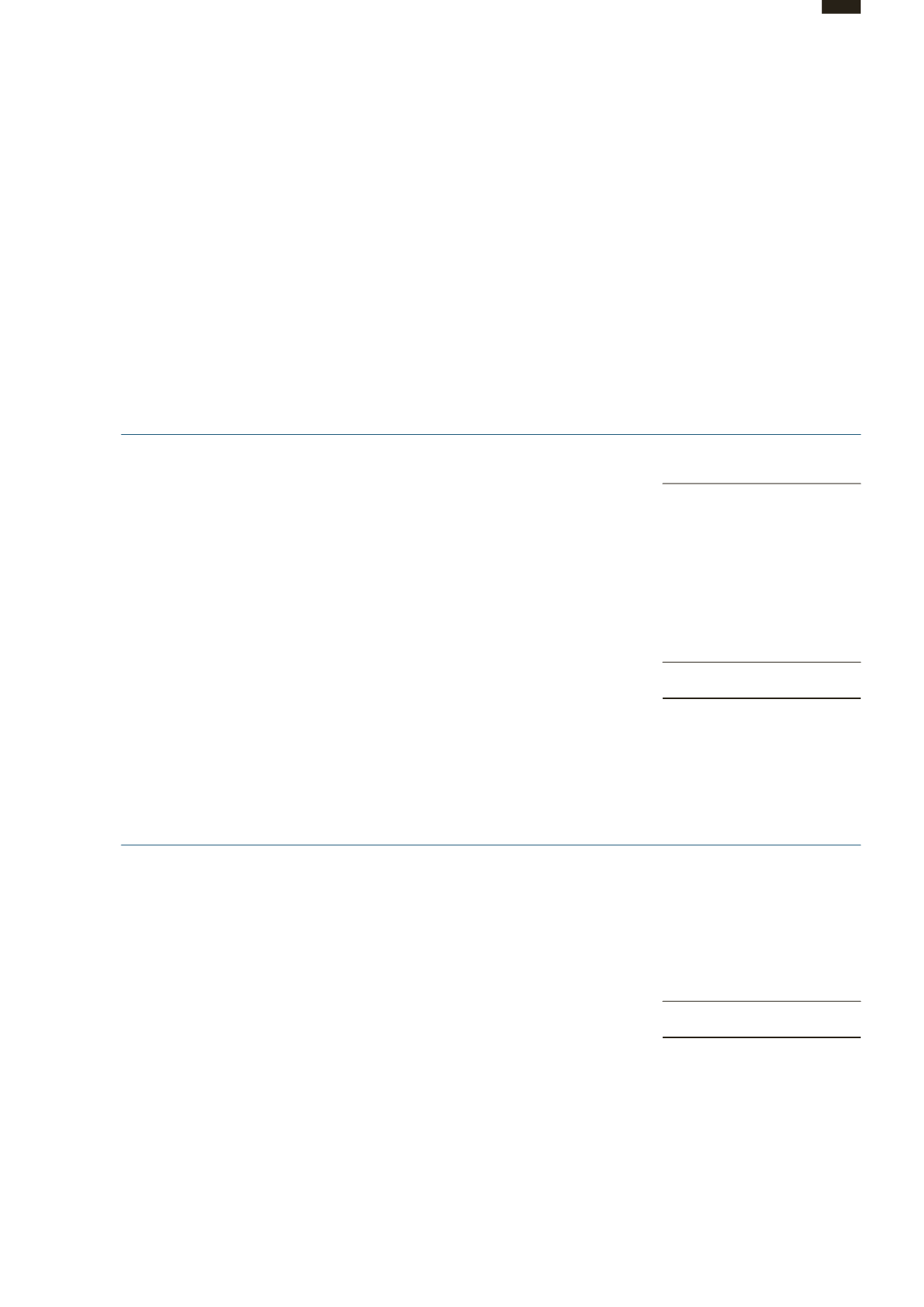

8

DISTRIBUTIONS

2015

2014

HK$’000

HK$’000

For the period from 1 July 2013 to 31 December 2013

Distribution of 22.30 HK cents per unit

-

1,942,576

For the period from 1 January 2014 to 30 June 2014

Distribution of 18.70 HK cents per unit

-

1,628,975

For the period from 1 July 2014 to 31 December 2014

Distribution of 22.30 HK cents per unit

1,942,576

-

For the period from 1 January 2015 to 30 June 2015

Distribution of 15.70 HK cents per unit

1,367,643

-

3,310,219

3,571,551

On 2 February 2016, the Board of Directors of the Trustee-Manager recommended the distribution of 18.70 HK cents per unit

for the financial result from 1 July 2015 to 31 December 2015 (2014: 22.30 HK cents per unit) amounting to HK$1,629.0 million

(2014: HK$1,942.6 million) and payable on 24 March 2016. This distribution is not reflected in these financial statements and

will be recognised in equity as an appropriation of retained profits in the financial year ending 31 December 2016.

9

EARNINGS/LOSS¡ PER UNIT

The calculation of earnings/(loss) per unit is based on profit attributable to unitholders of HPH Trust of HK$1,744,899,000 for the

year ended 31 December 2015 (2014: loss attributable to unitholders of HPH Trust of HK$17,191,955,000) and on 8,711,101,022 units

in issue (2014: 8,711,101,022 units in issue), which is the weighted average number of units for the year ended 31 December 2015.

Diluted earnings/(loss) per unit is the same as the basic earnings/(loss) per unit for the years ended 31 December 2015 and 2014.

Notes to the

Financial Statements

089

ANNUAL REPORT 2015

HUTCHISON PORT HOLDINGS TRUST