20 TRADE AND OTHER RECEIVABLES CONTINUED¡

Notes:

(a) The amounts due from related companies, associated companies and joint ventures of the Group are unsecured,

interest free and have no fixed terms of repayment.

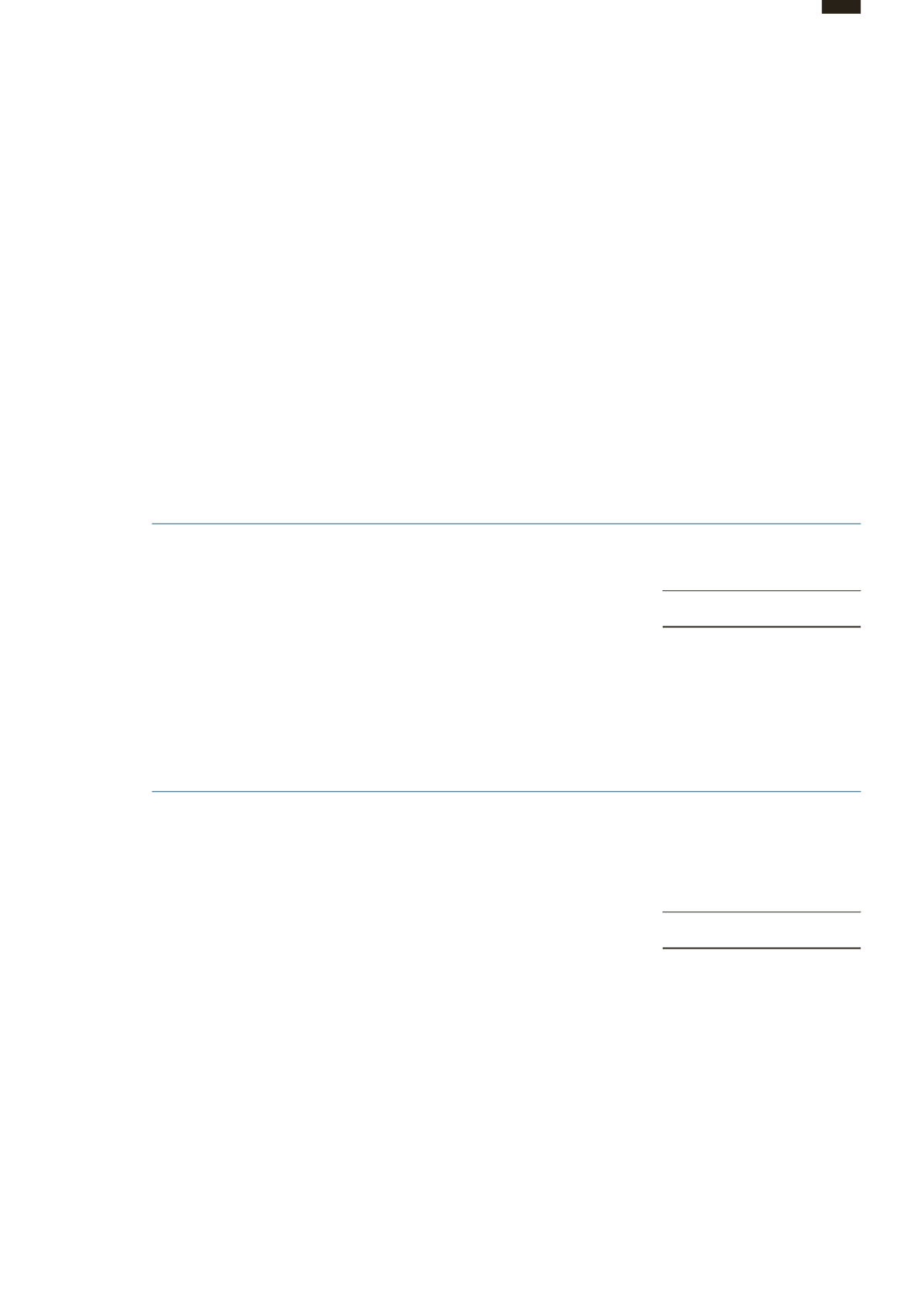

(b) At 31 December 2015, trade receivables of the Group amounting to HK$1,391,857,000 (2014: HK$1,057,471,000) were

past due but not impaired. These relate to a number of independent customers for whom there is no recent history of

default. The ageing analysis of these trade receivables is as follows:

2015

2014

HK$’000

HK$’000

Up to 2 months

654,644

594,113

2 to 3 months

213,446

218,820

Over 3 months

523,767

244,538

1,391,857

1,057,471

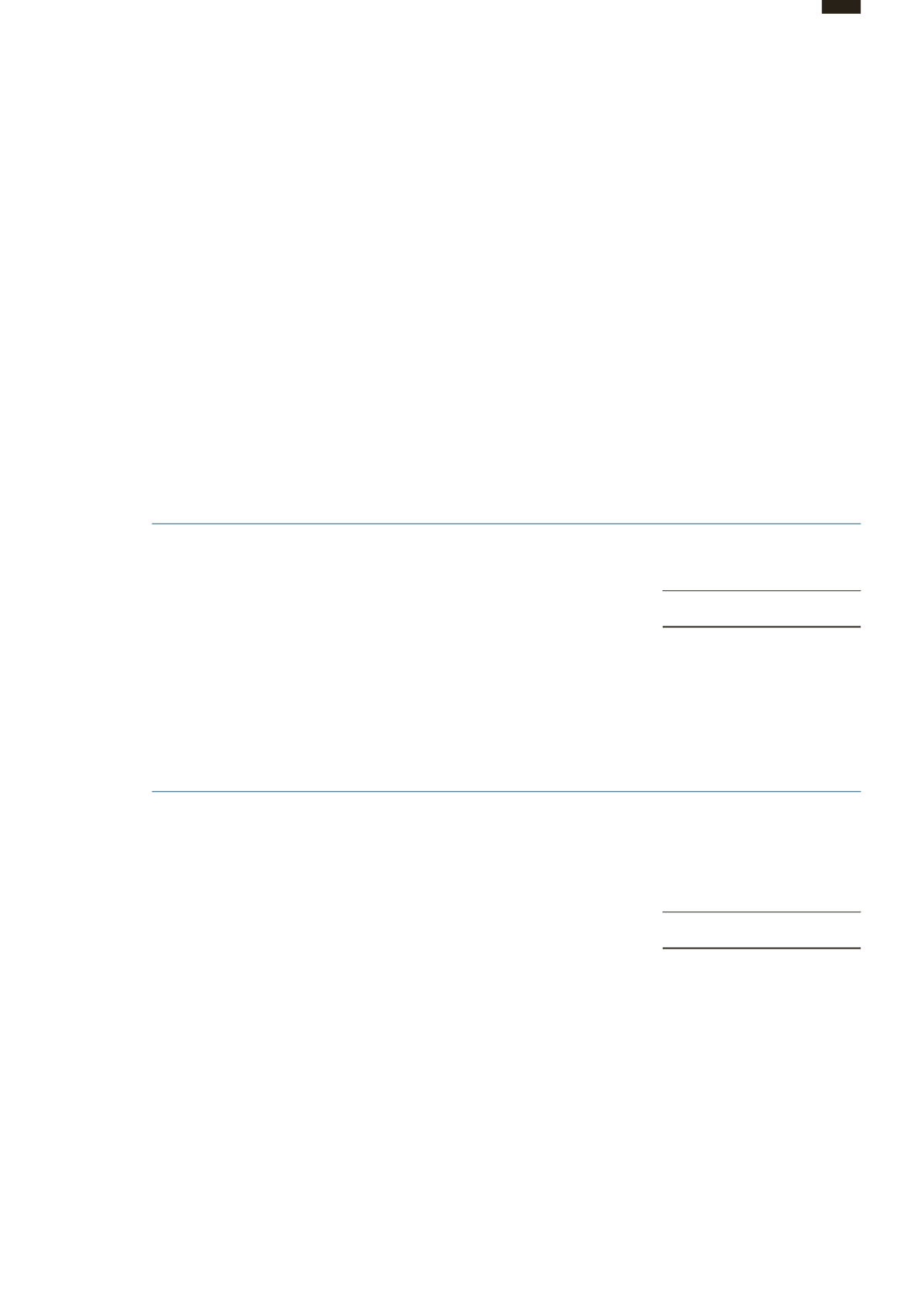

(c) At 31 December 2015, trade receivables of the Group amounting to HK$14,961,000 (2014: HK$11,967,000) were impaired

and provided for. The impaired receivables are balances in dispute with customers. The Group does not hold any

collateral over these balances.

Movements of provisions for impairment of trade receivables of the Group are as follows:

2015

2014

HK$’000

HK$’000

At beginning of the year

11,967

14,553

Provision for impairment

3,899

1,908

Write back of provision for impairment

(561)

(4,033)

Receivables written o

as uncollectible

(173)

(37)

Disposal of subsidiary companies

-

(319)

Currency translation di

erences

(171)

(105)

At end of the year

14,961

11,967

The creation and release of provisions for impairment of receivables have been included in the income statement.

Amounts charged to the provision for impairment of receivables are generally written o

when there is no expectation

of recovering additional cash.

The other classes within trade and other receivables do not contain impaired assets.

The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivables

mentioned above.

Notes to the

Financial Statements

099

ANNUAL REPORT 2015

HUTCHISON PORT HOLDINGS TRUST