23 PENSION OBLIGATIONS CONTINUED¡

(a) Defined benefit plans (Continued)

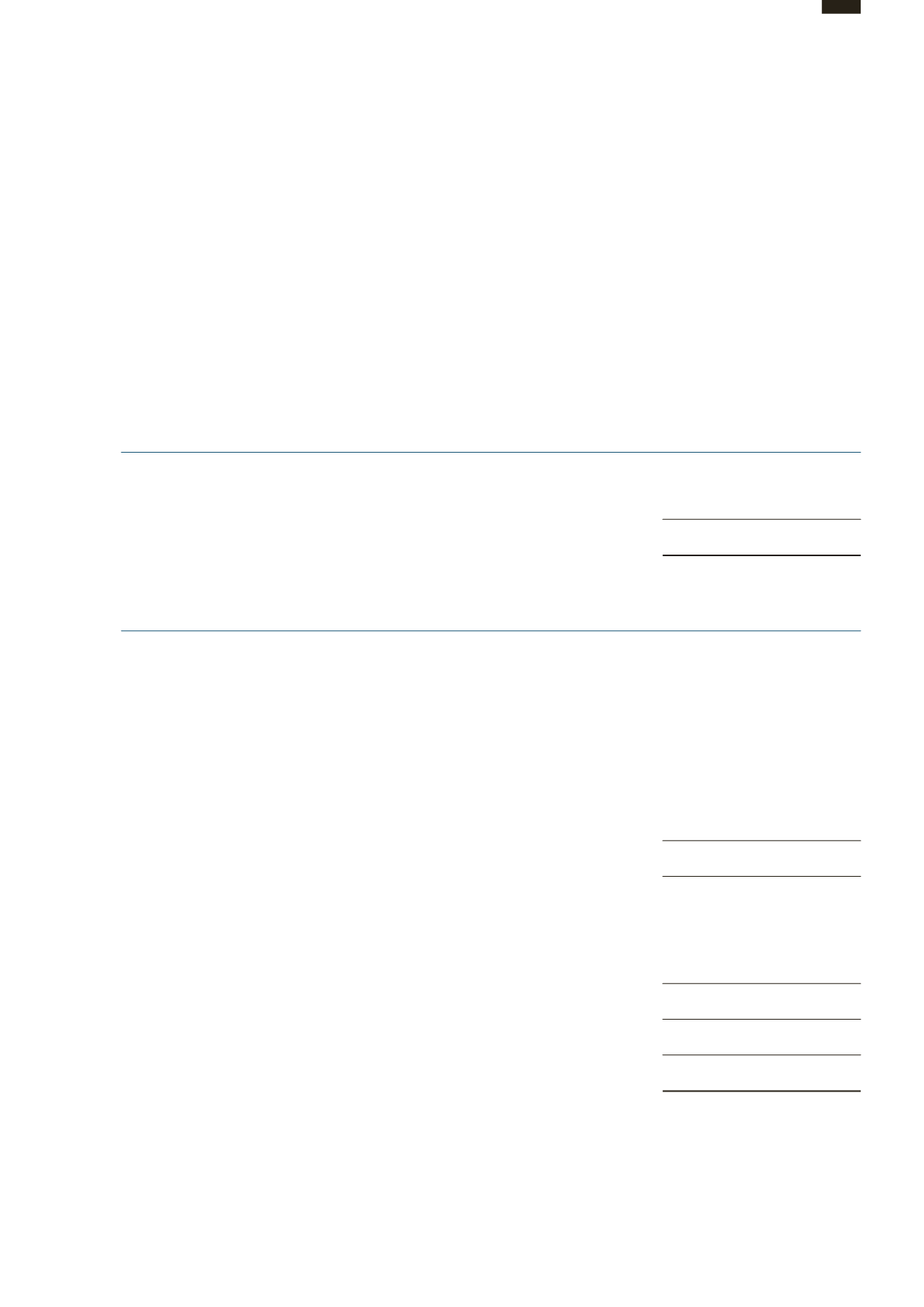

Fair value of the plan assets is analysed as follows:

2015

2014

HK$’000

HK$’000

Equity instruments

811,092

809,202

Debt instruments

326,842

316,752

Cash and others

30,588

30,048

At 31 December

1,168,522

1,156,002

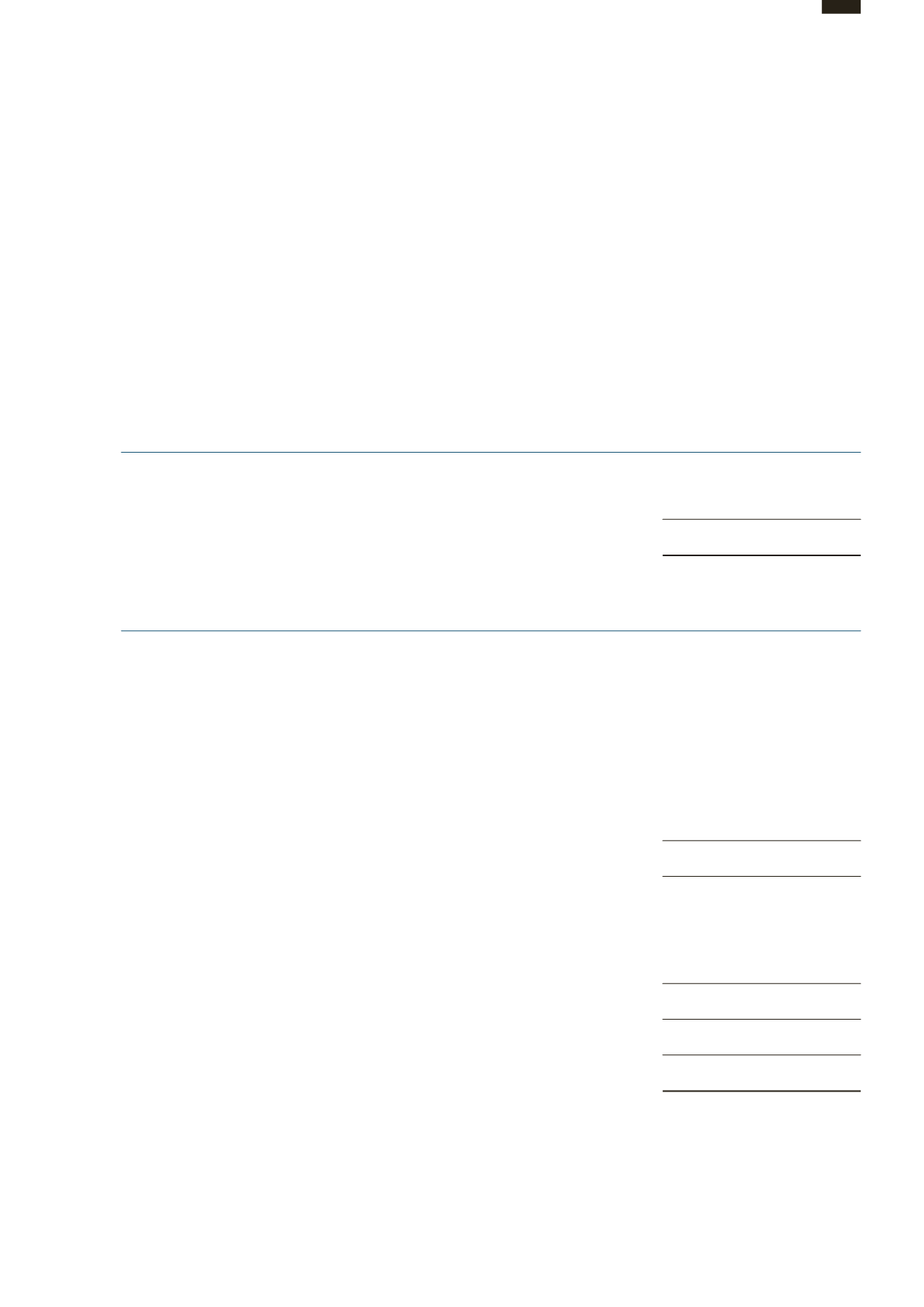

2015

2014

Percentage

Percentage

Equity Instruments

Conglomerates and manufacturing

6%

5%

Construction and materials

2%

2%

Consumer markets

6%

8%

Energy and utilities

4%

4%

Financial institutions and units trust

20%

20%

Health and care

6%

6%

Insurance

5%

4%

Real estate

4%

4%

Information technology

11%

11%

Others

5%

6%

69%

70%

Debt instruments

Government (other than US)

10%

8%

Financial institutions

3%

4%

US Treasury

6%

6%

Others

9%

9%

28%

27%

Cash and others

3%

3%

100%

100%

Notes to the

Financial Statements

105

ANNUAL REPORT 2015

HUTCHISON PORT HOLDINGS TRUST