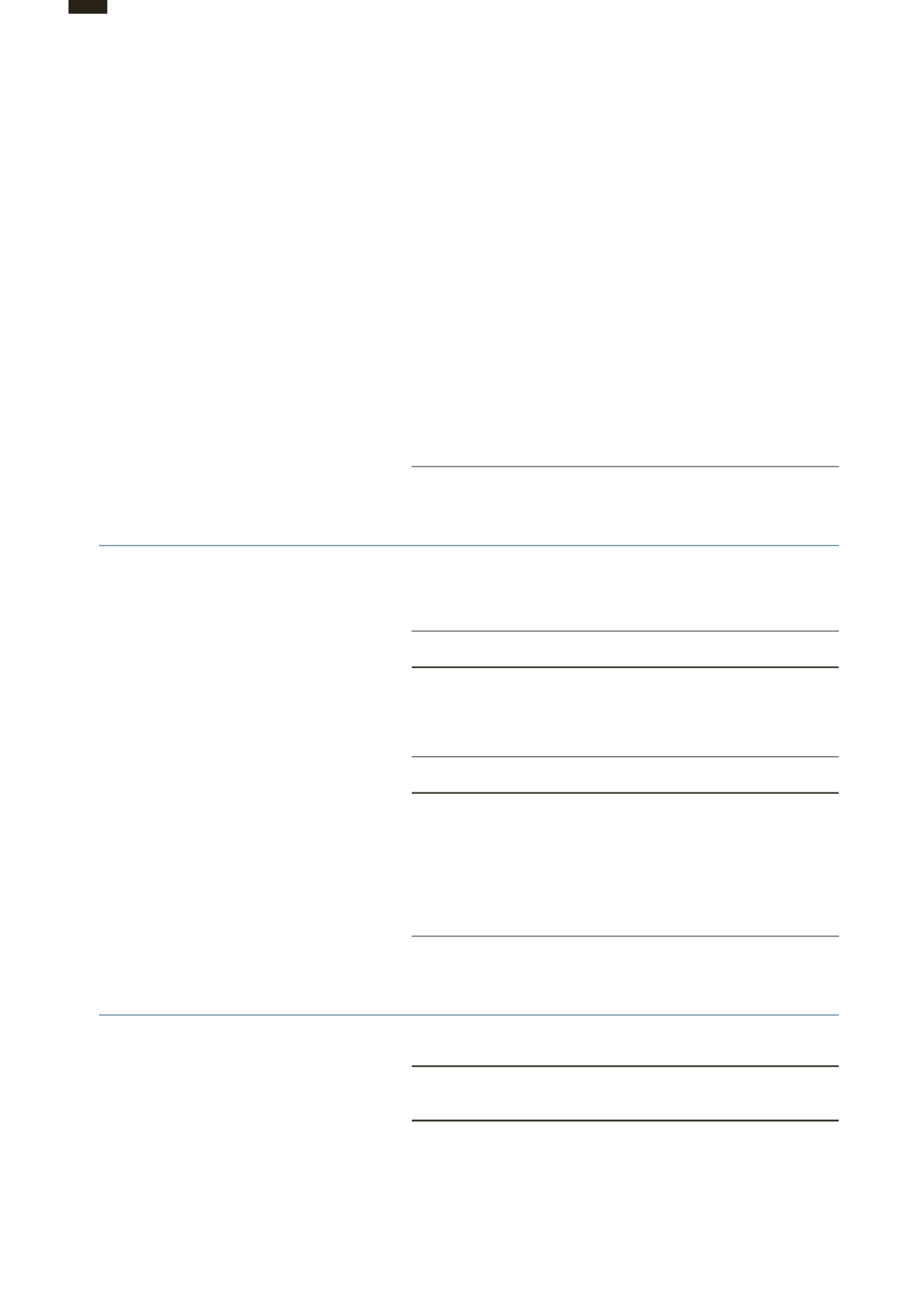

30 FINANCIAL RISK AND CAPITAL MANAGEMENT CONTINUED¡

(f) Liquidity exposure

The following tables detail the remaining contractual maturities at the end of the reporting period of the Group’s and the

Trust’s financial liabilities, which are based on contractual undiscounted principal cash flows and the earliest date on which

the Group and the Trust can be required to pay:

Group

Contractual maturities

Total

Carrying

Undiscounted

Within

Within

amounts

cash flows

1 year

2 to 5 years

HK$’000

HK$’000

HK$’000

HK$’000

2015

Trade and other payables

7,294,967

7,294,967

7,294,967

-

Bank and other debts, and other

non-current liabilities

33,050,320

33,181,705

8,947,044

24,234,661

40,345,287

40,476,672

16,242,011

24,234,661

2014

Trade and other payables

6,940,993

6,940,993

6,940,993

-

Bank and other debts, and other

non-current liabilities

33,701,065

33,754,400

8,195,200

25,559,200

40,642,058

40,695,393

15,136,193

25,559,200

The table for the Group above excludes interest accruing and payable on certain of these liabilities which are estimated

to be HK$590,146,000 (2014: HK$514,511,000) in “within 1 year” maturity band, HK$924,239,000 (2014: HK$777,499,000) in

“within 2 to 5 years” maturity band, and after assuming the e

ect of interest rates with respect to variable rate financial

liabilities remaining constant and no change in aggregate principal amount of financial liabilities other than repayment at

scheduled maturity as reflected in the table.

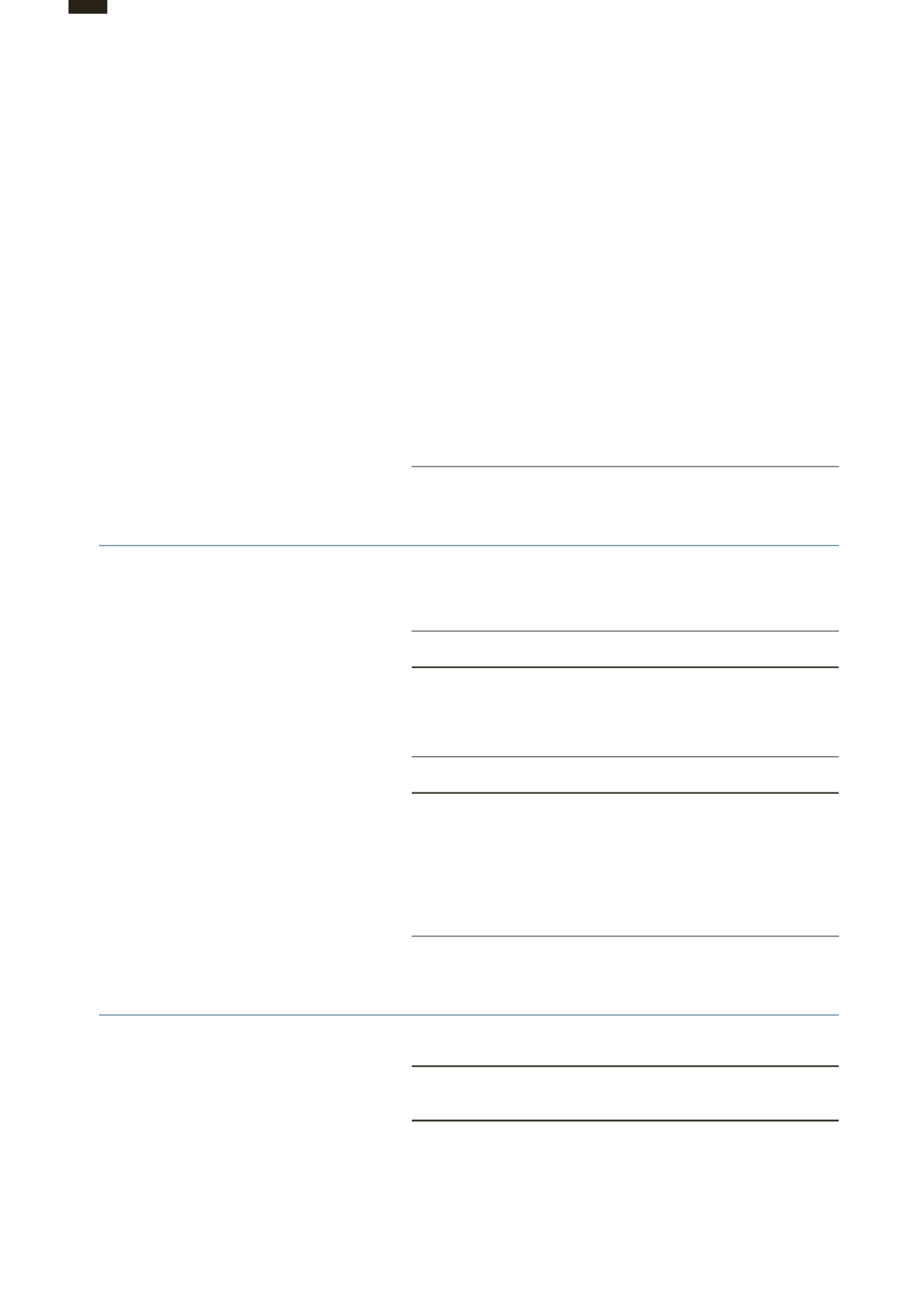

Trust

Contractual maturities

Total

Carrying

Undiscounted

Within

Within

amounts

cash flows

1 year

2 to 5 years

HK$’000

HK$’000

HK$’000

HK$’000

2015

Trade and other payables

52,329

52,329

52,329

-

2014

Trade and other payables

39,142

39,142

39,142

-

Notes to the

Financial Statements

OPTIMISING FOR THE FUTURE

114