23 PENSION OBLIGATIONS CONTINUED¡

(a) Defined benefit plans (Continued)

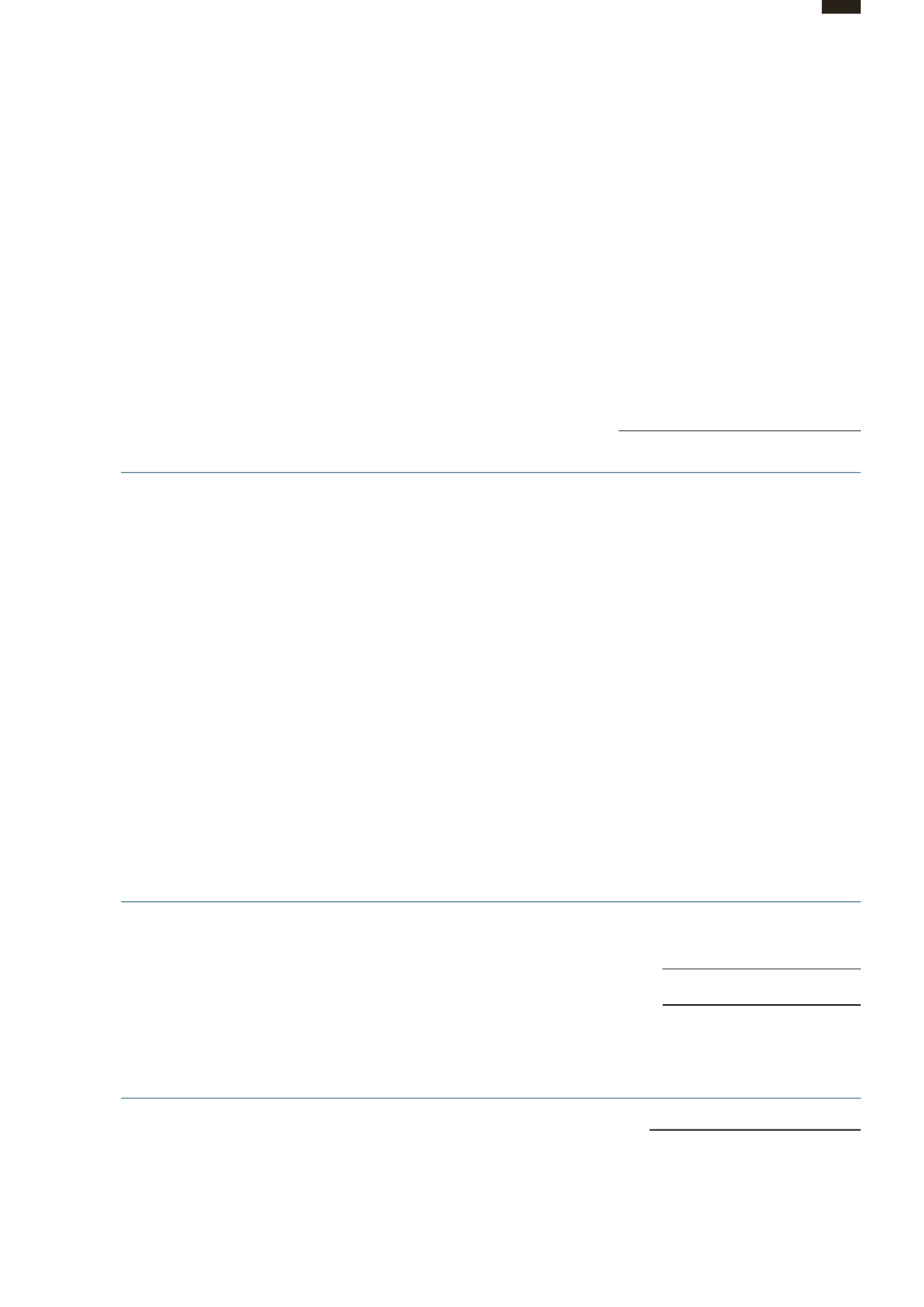

The sensitivity of the defined benefit obligation to changes in the significant principal assumptions is:

Impact on defined benefit obligation

Change in

Increase in

Decrease in

assumption

assumption

assumption

Discount rate

0.25%

Decrease by 1.9%

Increase by 2.0%

Salary increase

0.25%

Increase by 0.6%

Decrease by 0.5%

The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant. In

practice, this is unlikely to occur, and changes in some of the assumptions may be correlated. When calculating the sensitivity

of the defined benefit obligation to significant actuarial assumptions, the same method (present value of the defined benefit

obligation calculated with the projected unit credit method at the end of the reporting period) has been applied as when

calculating the pension liability recognised within the statement of financial position. The methods and types of assumptions

used in preparing the sensitivity analysis did not change compared to previous year.

Expected contributions to the defined benefit plans for the year ending 31 December 2016 are HK$39,029,000.

The weighted average duration of the defined benefit obligation is 7.9 years as at 31 December 2015 (2014: 8.2 years).

(b) Defined contribution plans

The Group’s cost in respect of defined contribution plans for the year amounted to HK$69,464,000 (2014: HK$67,938,000).

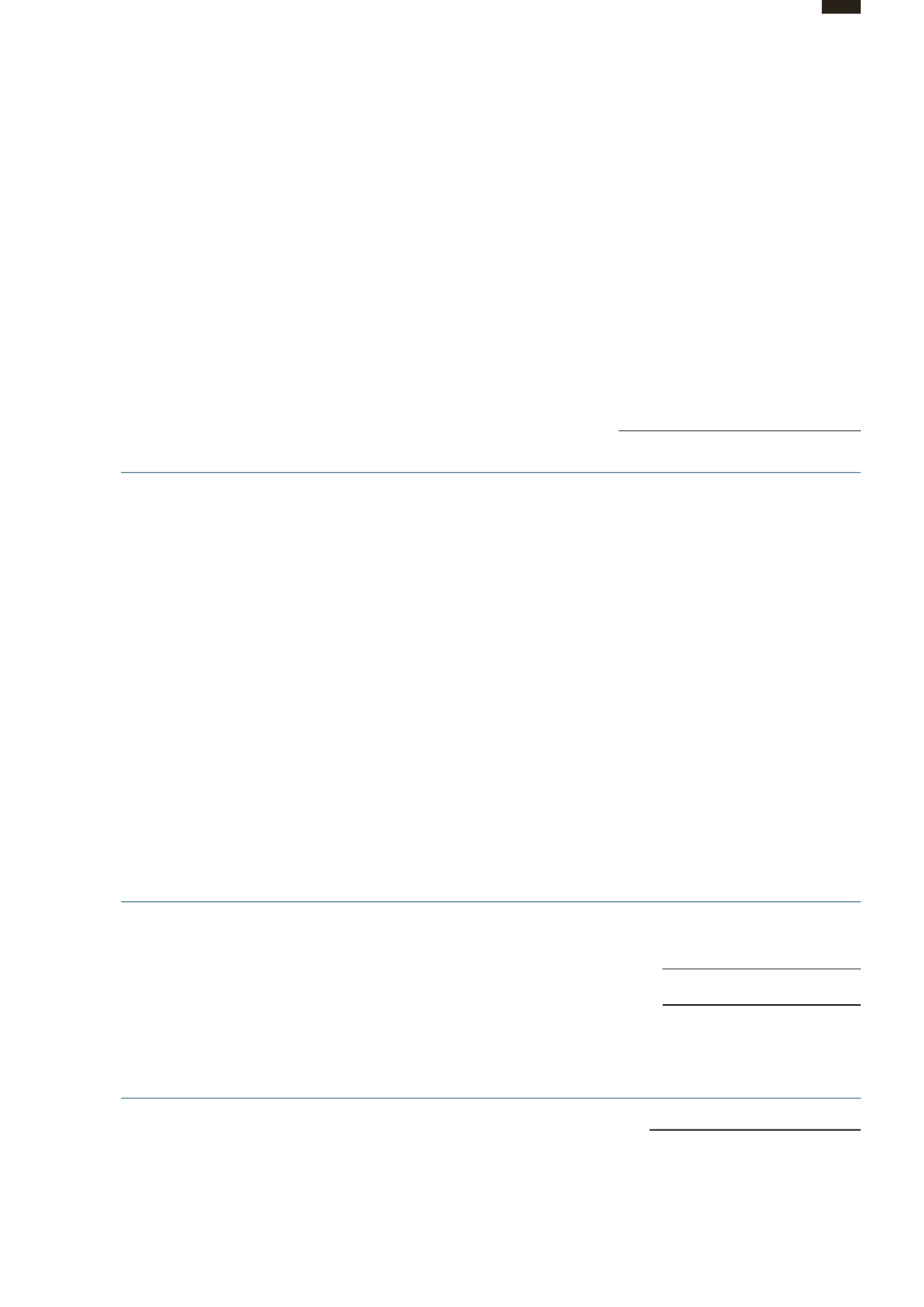

24 OTHER NONCURRENT LIABILITIES

Group

2015

2014

HK$’000

HK$’000

Fair value hedges

Interest rate swaps

38,784

-

Others

18,079

19,651

56,863

19,651

25 UNITS IN ISSUE

Group and Trust

Number of

units

HK$’000

At 1 January 2014, 31 December 2014 and 31 December 2015

8,711,101,022

68,553,839

All issued units are fully paid and rank pari passu in all respects.

Notes to the

Financial Statements

107

ANNUAL REPORT 2015

HUTCHISON PORT HOLDINGS TRUST