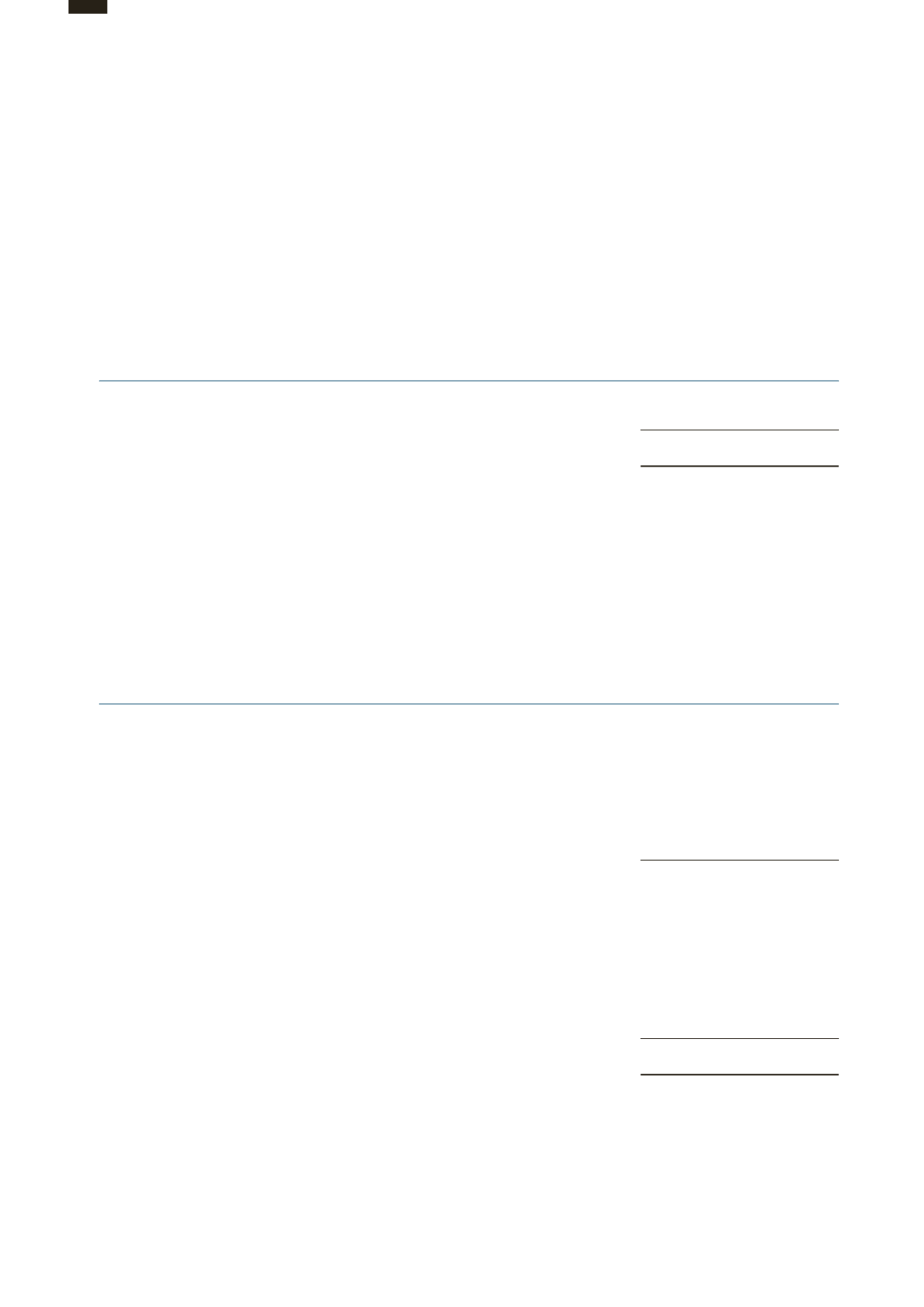

26 INVESTMENT IN A SUBSIDIARY

Trust

2015

2014

HK$’000

HK$’000

Investment cost

10,000

10,000

Capital contribution

57,551,334

60,883,189

57,561,334

60,893,189

Pursuant to an investment agreement entered between the HPH Trust and a wholly-owned subsidiary, HPHT Limited, dated

4 August 2011, HPH Trust made capital contributions of HK$67,280,000,000 to HPHT Limited (“Capital Contribution”)

through capitalising the amounts due from the subsidiary. HPH Trust has no right to require HPHT Limited to return any

Capital Contribution. HPHT Limited may return to HPH Trust any Capital Contribution at any time in whole or in part.

Accordingly, the capital contribution is accounted for as investment in a subsidiary.

Details of subsidiary companies of the Group are disclosed in Note 31.

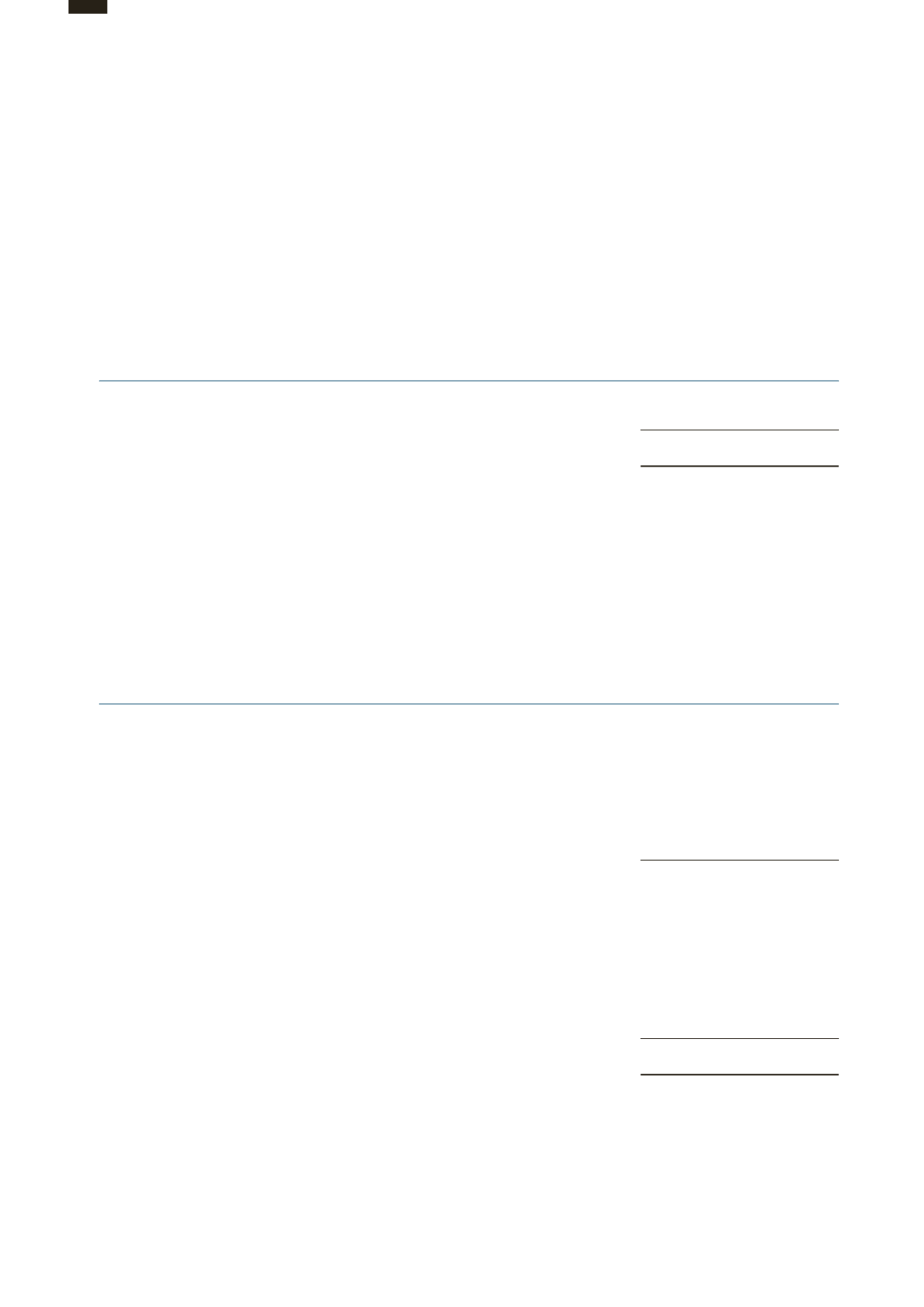

27 RECONCILIATION OF OPERATING PROFIT TO CASH GENERATED FROM OPERATIONS

2015

2014

Note

HK$’000

HK$’000

Operating profit

4,352,691

4,160,261

Depreciation and amortisation

2,821,195

2,805,347

Net gain on disposal of subsidiary companies

-

(243,777)

Gain on cessation of economic benefits of an investment

17

(155,532)

-

Net loss/(gain) on disposal of fixed assets

2,733

(1,926)

Dividend income

(23,727)

(50,718)

Interest income

(65,420)

(87,677)

Operating profit before working capital changes

6,931,940

6,581,510

Decrease in inventories

10,290

8,308

Increase in trade and other receivables

(496,271)

(174,990)

Decrease/(increase) in amounts due from related companies,

associated companies and joint ventures

71,239

(43,157)

Increase in trade and other payables

244,539

286,496

Increase in pension obligations

16,748

10,695

Cash generated from operations

6,778,485

6,668,862

Notes to the

Financial Statements

OPTIMISING FOR THE FUTURE

108