30 FINANCIAL RISK AND CAPITAL MANAGEMENT CONTINUED¡

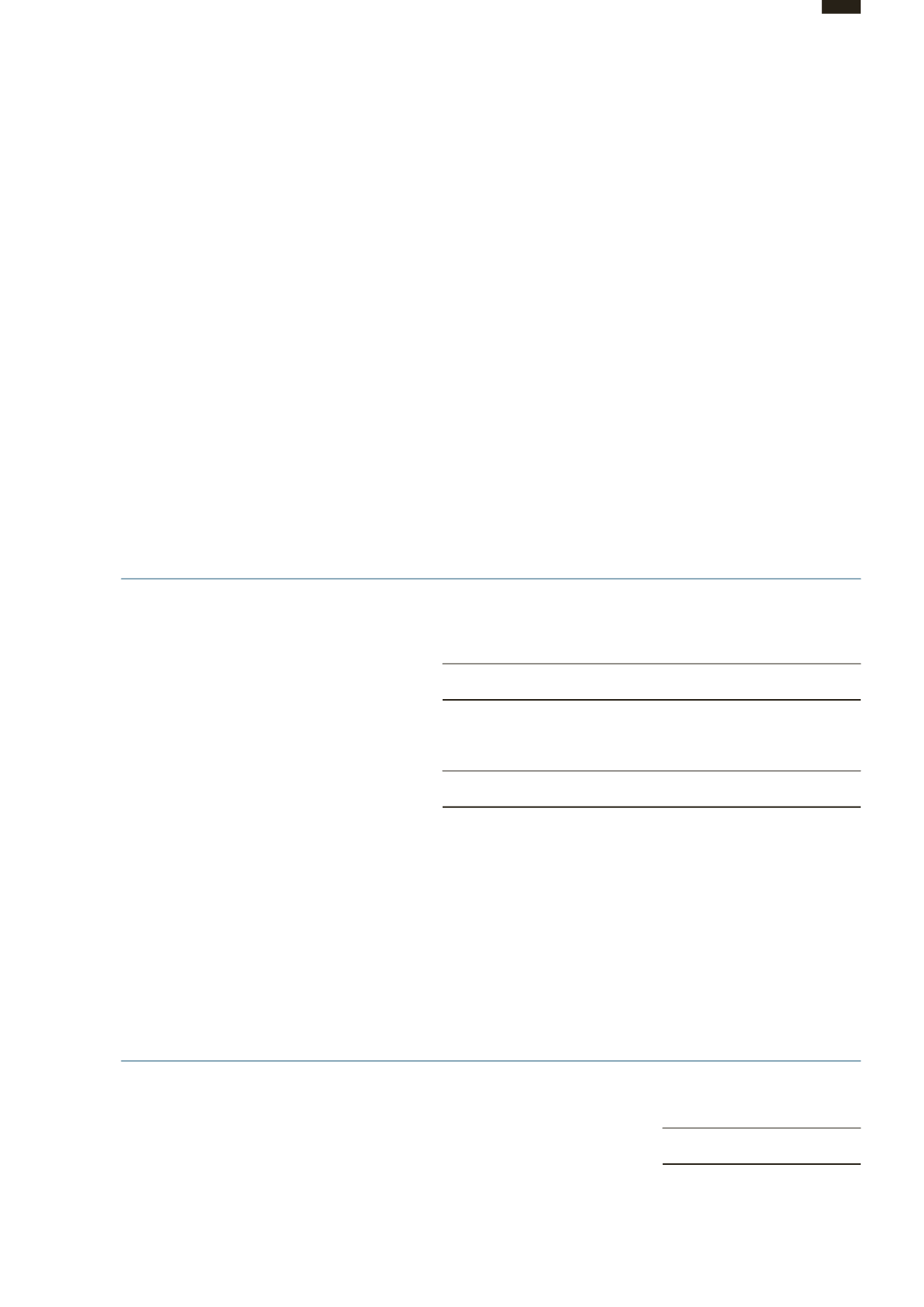

(g) Fair value estimation

The table below analyses recurring fair value measurements for financial assets/(liabilities). These fair value measurements

are categorised into di

erent levels in the fair value hierarchy based on the inputs to valuation techniques used. The di

erent

levels are defined as follows:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the assets or liabilities, either

directly (i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3: Inputs for the assets or liabilities that are not based on observable market data (i.e. unobservable inputs).

Level 1

Level 2

Level 3

Total

Note

HK$’000

HK$’000

HK$’000

HK$’000

At 31 December 2015

Listed equity security

17

60,413

-

-

60,413

River Ports Economic Benefits

17

-

-

518,600

518,600

Fair value hedges on interest rate swaps

24

-

(38,784)

-

(38,784)

60,413

(38,784)

518,600

540,229

At 31 December 2014

Listed equity security

17

58,388

-

-

58,388

River Ports Economic Benefits

17

-

-

740,000

740,000

58,388

-

740,000

798,388

The fair value of financial instruments that are not traded in active market (level 3) is determined by discounted cash flow

analysis with reference to inputs such as dividend stream.

During the years ended 31 December 2015 and 2014, there were no transfers between the Level 1, Level 2 and Level 3 fair

value measurements.

At 31 December 2015, the fair value of bank and other debts (note 22) was HK$32,989.3 million. The carrying amounts of the

remaining financial assets and financial liabilities approximate their fair values.

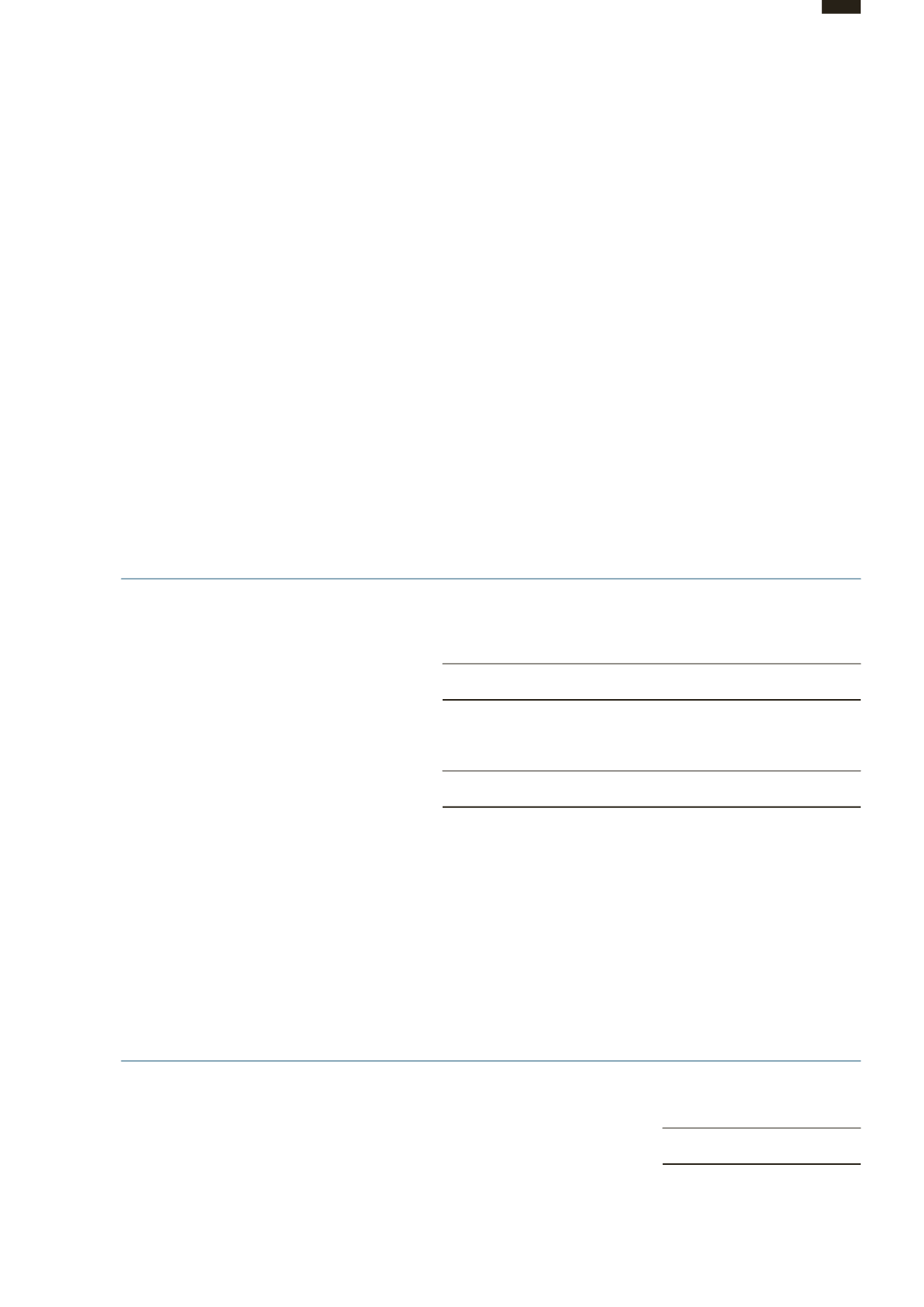

The movements of the balance of River Port Economic Benefits which is categorised into Level 3 are as follows:

2015

2014

HK$’000

HK$’000

At 1 January

740,000

775,000

Valuation losses taken to reserves

(29,700)

(35,000)

Derecognition

(191,700)

-

At 31 December

518,600

740,000

Changing unobservable inputs used in Level 3 valuation to reasonable alternative assumptions would not have significant

impact on the Group’s profit or loss.

Notes to the

Financial Statements

115

ANNUAL REPORT 2015

HUTCHISON PORT HOLDINGS TRUST