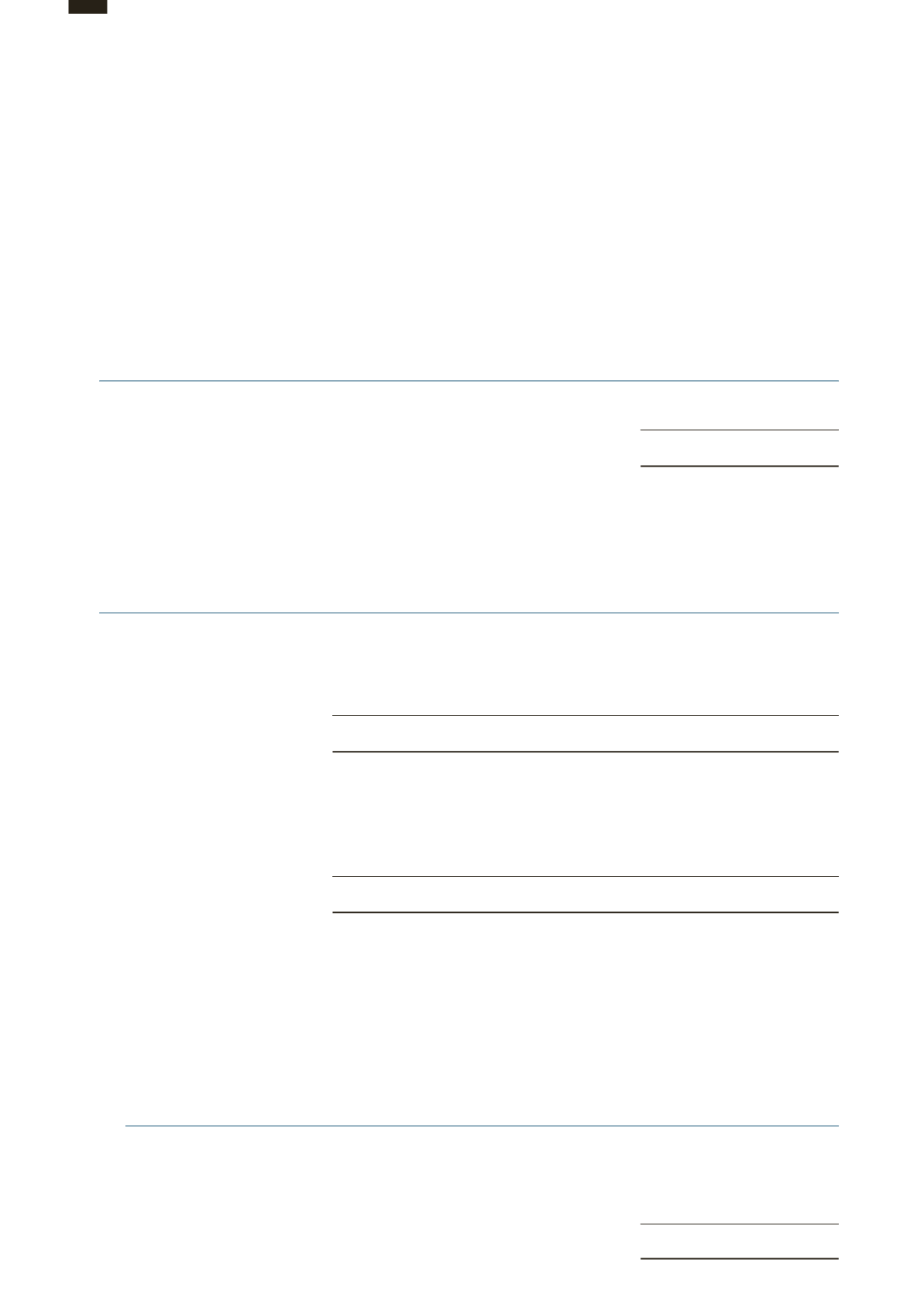

18 DEFERRED TAX

Group

2015

2014

HK$’000

HK$’000

Deferred tax assets

(12,695)

(12,868)

Deferred tax liabilities

11,204,694

11,442,991

Net deferred tax liabilities

11,191,999

11,430,123

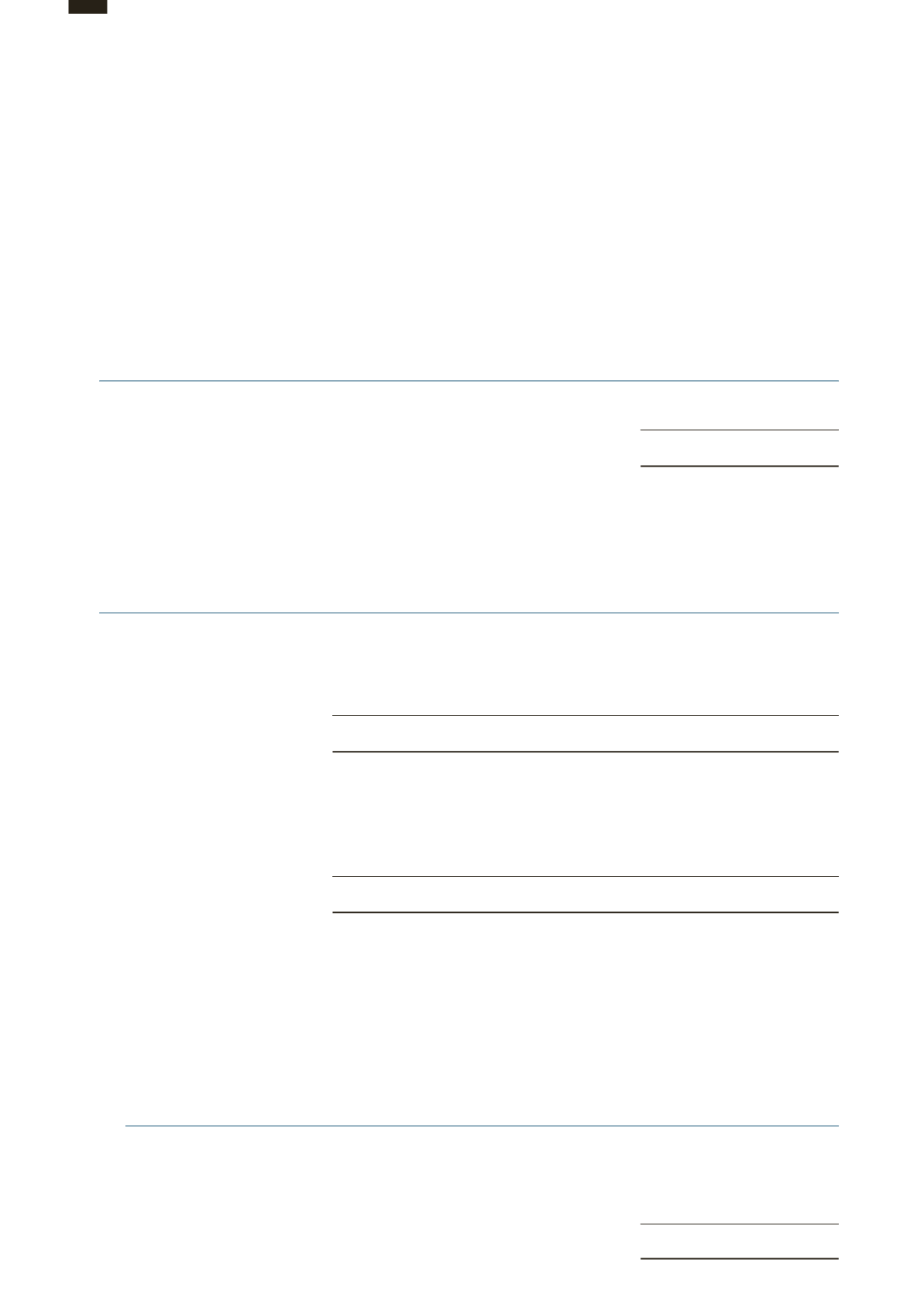

The movements in deferred income tax (assets)/liabilities during the year are as follows:

Fair value Withholding

Accerlerated adjustments

tax on

Unused tax depreciation arising from unremitted

losses allowances acquisitions

earnings

Others

Total

HK$’000

HK$’000

HK$’000

HK$’000

HK$’000

HK$’000

2015

At 1 January 2015

(17,612)

583,169

10,674,440

190,438

(312)

11,430,123

Tax (credited)/charged to

income statement

(544)

17,187

(287,424)

32,693

(1)

(238,089)

Other temporary di

erences

-

17

(67)

(173)

188

(35)

At 31 December 2015

(18,156)

600,373

10,386,949

222,958

(125)

11,191,999

2014

At 1 January 2014

(22,021)

715,130

11,288,489

185,254

(394)

12,166,458

Disposal of subsidiary companies

-

(147,010)

(318,916)

-

52

(465,874)

Tax charged/(credited) to

income statement

4,409

15,049

(295,066)

5,184

107

(270,317)

Other temporary di

erences

-

-

(67)

-

(77)

(144)

At 31 December 2014

(17,612)

583,169

10,674,440

190,438

(312)

11,430,123

Notes:

(a) The deferred tax assets and liabilities are o

set when there is a legally enforceable right to set o

and when the deferred

income taxes relate to the same fiscal authority.

(b) Deferred tax assets are recognised for tax losses carried forward to the extent that realisation of the related tax benefit

through the future taxable profit is probable. The Group has unrecognised tax losses of HK$410,613,000 at 31 December 2015

(2014: HK$406,915,000) to carry forward against future taxable income. Of these, HK$405,489,000 (2014: HK$405,765,000)

can be carried forward indefinitely. The remaining HK$5,124,000 (2014: HK$1,150,000) expires in the following years:

2015

2014

HK$’000

HK$’000

In the first year

-

-

In the second year

-

-

In the third year

-

-

In the fourth year

1,150

-

In the fifth year

3,974

1,150

5,124

1,150

Notes to the

Financial Statements

OPTIMISING FOR THE FUTURE

096