BALANCED CAPITAL STRUCTURE

HPH Trust maintains a balanced capital structure with leverage

of about 53%. Short-term debt forms around a quarter of

total consolidated debt. HPH Trust’s total outstanding bank

loans amount to HK$33.1 billion, with the majority of them

unsecured. Details of the bank loans are set out on page 101

of the Annual Report.

OUTLOOK FOR 2016

U.S. volumes are expected to grow by a low-to-mid single

digit percentage in 2016. Forecasts indicate that the U.S. will

continue on its gradual recovery path that first began in late

2014, with anticipated increases in consumer spending and

employment. This is expected to positively impact outbound

cargoes to the U.S.. A slowdown in China and a weaker

Renminbi (“RMB”) may be a stimulus to export trade and offer

slight easing of cost pressures in the Trust’s China operations

in the medium term. However, it is expected that fluctuations

in the RMB will contribute to market volatility in the immediate

and short term.

In Europe, all signs point to a slow recovery, with low oil prices

and a weak euro providing momentum for growth. European

volumes are expected to stabilise in the second half of 2016,

with potential for some uplift toward the latter half of the year.

In Hong Kong, we expect volume to remain flat as alliances

continue with service rationalistion.

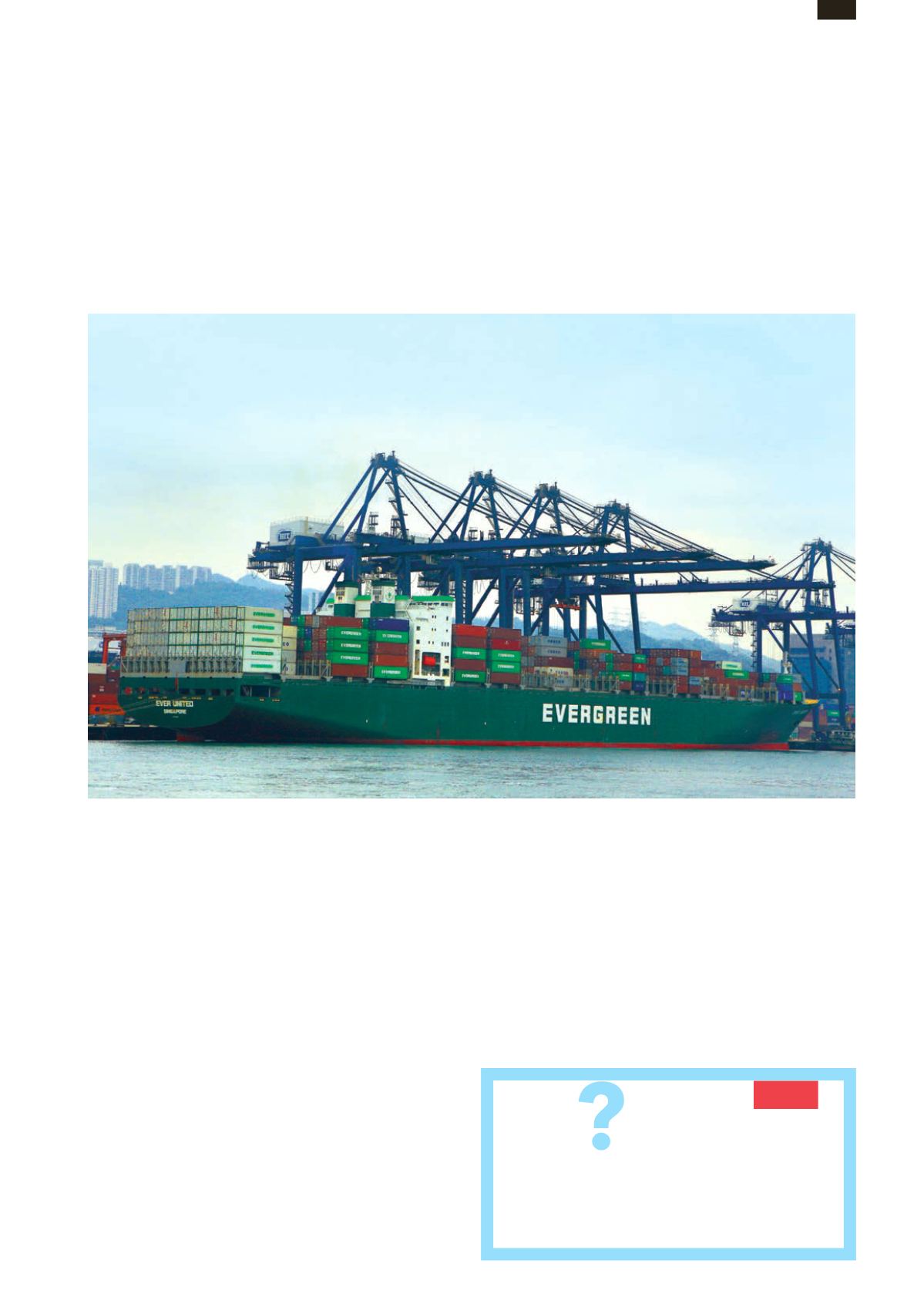

HPH Trust will continue to enhance its mega-vessel handling

capabilities by rolling out an additional mega-vessel berth in

YICT under the YICT Phase III Expansion.

By retaining its strong fundamentals and focusing on tari and

cost improvements, along with traditional practices of properly

managed financing arrangements and capital expenditure,

HPH Trust will continue to follow a steady and sustainable path of

growth, while ensuring stable annual distributions to unitholders.

Laid out on a single level, the 200 million TEU handled

by the Trust’s Hong Kong ports since operations began

would be enough to cover the land area of Singapore

more than four times!

Fun Fact

DID YOU

KNOW

029

ANNUAL REPORT 2015

HUTCHISON PORT HOLDINGS TRUST